Parks on the ballot!

Do you love walkable, urban nature? Do you love property tax increases? Let's talk about it!

Before we start, for those of you are new here, welcome! This is an extremely infrequently updated newsletter/blog about Portland politics. You’ll find I tend to dive in to the minutia of public policy, its implementation, and the actual impacts of these things on Portlanders in their everyday lives. Hopefully you like that sort of thing.

I’m neither a journalist nor a professional about any of this stuff. Think of me more as an informed hobbyist—the neighbor you like to check in with before you submit your ballot.

For those of you who don’t know why I’m welcoming new subscribers, the Willamette Week gave Mortlandia a nice shout out in a recent issue. Thanks WW!

One thing that’s a challenge when you’re writing for free on the internet is that you’re often not writing on much of a deadline. A blessing for me, insofar as I don’t have to treat this like a real job. But also a bit of a curse because by the time I can do my research, everyone else has dropped their endorsements.

So if you want to see what the other folks think, check them out:

Oregonian: No

Willamette Week: Yes

Since you’re already here, though, let’s talk Parks. Because I have thoughts.

2025 Portland Parks Levy

Portland Parks are pretty great. Under-maintained, perhaps. But beautiful, plentiful, large. Sometimes I think about Peninsula Park. By Portland standards, it’s definitely not top 3. Maybe not top 5. But it’s got a pool, a splash pad, a concert gazebo, a 2 acre rose garden. In many cities, Peninsula would be a destination. Here, it’s almost an afterthought. There’s a reason why our parks reliably rank top 10, nationwide.

It also costs money! Which is why there’s a levy renewal on the ballot.

What is it?

A tax. Specifically, a 5 year tax on assessed home values of $1.40 per $1,000 of assessed value. It replaces a 2020 levy of $0.80 per $1,000 of assessed value.

The median home is PDX is assessed at $221,600. (If that sounds low to you, it is, and it has to do with the weird way we assess property taxes here. It’s complicated and a subject for next time.)1

What does that mean? For the median homeowner, that means:

2025 Levy: $221,600 x ($1.40 / $1,000) = $310 per year ~= $26 per month

2020 Levy (current rate): $221,600 x ($0.80 / $1,000) = $177 per year ~= $15 per month

Those numbers will hit you a bit higher or a bit lower depending on when your home was built and how bougie your neighborhood was in the 90’s. As a homeowner, this tax will show as a line item in your yearly tax bill.2 As a renter, it’s all just wrapped up in your monthly rental cost.

The vast majority of this revenue will pay for ongoing park operations costs (e.g. money to park staff, mostly), with a token amount (~2%) going towards deferred capital maintenance.

So that’s the (rather stark) choice. Pay ~$11 more a month for continued park services at the current level or pay ~$15 less a month and a couple hundred park staff lose their jobs.3 There is no third option.

Why is it on the ballot?

In 2002, voters approved measure 26-34, a 5 year levy of $0.39 per $1,000 assessed. That ran for 5 years and raised $9M+ a year. Once that lapsed, we just paid for Parks out of the general fund for a decade or so. But as costs outpaced revenue from fees and whatnot, it was clear this wasn’t sustainable and the Parks bureau faced a significant shortfall every year.

In order to cover the shortfall the 2020 levy was whipped up.

But costs have gone up. According to levy backers, so too must the levy in order to keep service levels as is.

The Argument Against

Let’s cover the obvious point first.

This is a 75% increase in the levy, after 5 years. Inflation, over that same period is 25%. That’s a huge delta and we need to understand that to vote for (or against this) this clear-eyed.

I always recommend that folks scan the voter’s guide for every race. There’s often a lot of rubbish in there but every once in awhile you’ll find a gem. This election is no exception. The arguments in favor include a pretty broad coalition of electeds, special interest groups, unions, business associations, and neighborhood associations. They are basically all saying, “yay parks! Portland Parks are great!”

On the negative side it’s mostly anti-tax zealot nonsense. Still, one argument in opposition caught my eye, from an architect and former school superintendent. I’m going to reprint it here in full since I feel like it’s a pretty good steelman of the “No” position.

We Love Our Parks! That’s Why We’re Voting NO!

Parks Are Treasures—But We Need Real Solutions

Our parks enrich our lives. But loving our parks means demanding a plan that sustains them—not just throwing more money at a system that’s failing to deliver.

The Problem With This Levy

The proposed levy is a 75% tax hike. Supporters say it will “save” our parks, but it actually locks us into an unsustainable spiral. Without a course change, levies will keep rising every five years while Park services stagnate— and one in five park assets remain at risk of failure or closure within 15 years.

Since the 2020 levy:

Parks’ authorized staffing jumped from 521 to 826 positions

New, maintenance-intensive amenities were added

Critical repairs at existing assets were sidelined

The backlog of repairs ballooned from $450 million to $600 million

Portland already spends $318 per person on parks— well above the national average of $192. The issue isn’t funding; it’s discipline.

What Supporters Don’t Tell You

Out of the proposed $1.40 per $1,000 tax rate, just three cents—about $2 million per year—will be dedicated to major maintenance. That won’t scratch the surface of the $600 million capital maintenance crisis. The rest—$84 million annually—will continue funding the operational bloat that created this crisis.

A Smarter Alternative

This is not a do-or-die vote. The City Council still has time to propose a smarter, more balanced levy. For instance, a $1.00 tax rate with 20 cents dedicated to capital maintenance would yield over $13 million annually for maintenance—nearly seven times more than the proposed levy provides.

Our Parks Deserve Better

A basic rule of budgeting is simple: don’t build what you can’t maintain. City Hall has ignored that rule while asking taxpayers for ever-bigger blank checks.

Vote NO on the 75% tax increase. Demand accountability and real stewardship of Portland’s park.

Bob Weinstein, Rod Merrick

This analysis passes the smell test and it’s pretty damning

In short:

Hiring has outpaced what we could afford.

We have a significant backlog of deferred maintenance.

New amenities keep getting added, increasing operational costs.

Analysis

I’m going to go deeper on each of these below but the tl;dr is pretty simple. All three of these criticisms are pretty valid. I think the only question then becomes: are they reason enough to vote “no”?

Hiring boom

Parks staff increased. Unfortunately I can only find granular data for spending in dollars, not in headcounts, so I don’t know the exact breakdowns of recreation staff vs. tree planters vs. whatever else. At minimum, 142 new full time positions were created in the first year after the 2020 levy, so the ~300 new heads over 5 years tracks. A lot of these positions (~85) were for tree maintenance but a bunch more were for various other things, including a lot of equity-related stuff.

Here’s the thing: this was entirely expected! This is what the 2020 levy was for!

Quoting the 2020 levy directly, that money was to…

Proactively maintain existing park trees and plant hundreds of new trees each year where the rate of canopy cover is lower;

Prevent closures of community centers and pools;

Provide recreation programs, including summer camps, family-friendly movies and concerts, fitness and art classes, teen- and senior-focused programs, life-saving swim lessons, and a summer program serving free lunches to children experiencing poverty;

Remove financial barriers for low-income households by ending current dependence on recreation fee revenues;

Prioritize services for communities of color and households experiencing poverty, including equity centered outreach, community partnership grants, and increased engagement with volunteer and partner groups;

Modernize PP&R’s data systems to improve internal efficiency4

I have a hard time hating on Parks for making a bunch of hires when we passed a levy so that they could do a bunch of stuff that required hiring. There’s no evidence headcount will continue to increase at the same clip with this levy.

Backlog Maintenance

A tale of two cities. Similar climate, similar culture, similar challenges.

Acreage:

Portland: 14,000 acres (~9,000 acres if you exclude Forest Park)

Seattle: 6,800 acres

Per Capita Parks Spending

Portland: $145M / 635k = $228, per person, per year

Seattle: $228M / 780k = $292, per person, per year

Parks Deferred Maintenance Backlog

I imagine that Seattle maintenance backlog has grown in the last decade but I doubt it’s grown 3x. It’s pretty clear we have a maintenance backlog challenge given that 86% of Parks assets are in “poor” or “very bad” condition. But we’re also underinvesting, at least a little, compared to Seattle.

To me, $.03 of the levy going towards the maintenance backlog is simply not enough. I would like to see it closer to $.15 or $.20. This criticism of the levy strikes me as more than fair.

New Amenities without Maintenance

Portland has something called “System Development Charges (SDCs)”

SDCs are one-time fees assessed on new development that must be used for capital projects that expand park system capacity. Oregon law prohibits using SDC funds for operations and maintenance.

So… developers build (and thus pay SDCs), new park amenities get created, operational costs go up…but there’s no new funds to cover them. It’s a pretty vicious cycle. Another fair criticism

For now, at least, SDCs have been suspended by the mayor and governor. Folks in charge are aware of this dynamic. But there’s no real solve yet. The 2025 Levy is, one hopes, a bridge for the period between “understanding there is a structural problem” and “actually fixing the structural problem.” Time will tell.

Baumol’s Cost Disease

One last thing that I haven’t seen mentioned by anyone.

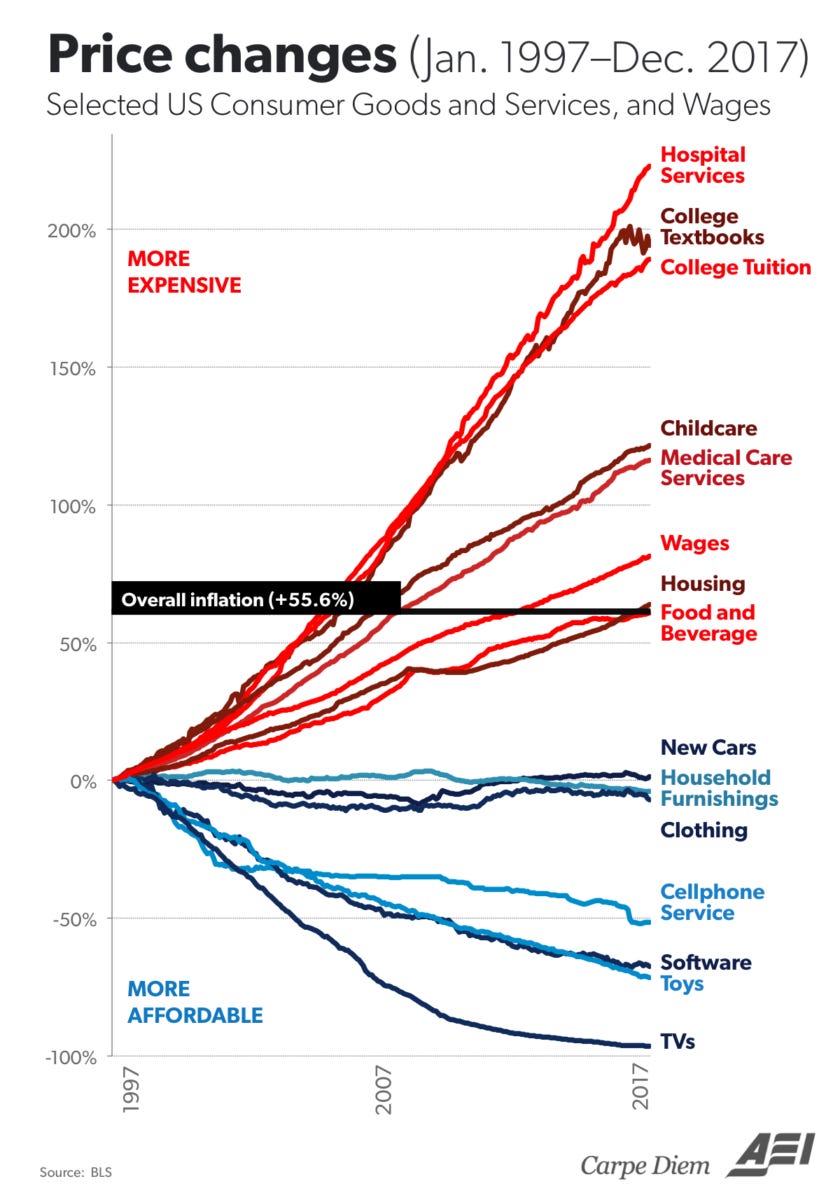

If you hang out in nerdy wonky internet parts, you may recognize this chart:

That’s changes in the “real” costs of goods and services over a 20-year time frame. There’s a lot to be said about this graph but I think the key takeaway is simple: industries with productivity improvements get cheaper over time. Industries without them get more expensive.

Cell phones are cheaper and better today because the factories where they are made are better and faster and more automated than they were 20 years ago. But childcare hasn’t seen productivity improvements. One childcare provider could watch over four infants 20 years ago. One childcare provider watches over four infants today. But their rent is higher, their costs are higher, so we have to pay them more. Which is what it is — childcare is great; child caretakers are great! But it does mean, as a percentage of our collective income, more and more inevitably goes to “low productivity” industries. This is known as Baumol’s Cost Disease.

We have some of this dynamic in Parks. Some work could be sped up / made more productive by technology: better mowers, more advanced arborist tooling, surveying drones, etc.

But much of it can’t. Unclogging toilets, lifeguarding at the pool—absent some wild new inventions, there just aren’t easy ways to increase the productivity of these jobs. So costs are going to naturally, continually, inexorably increase.

It’s something to watch as time marches on. Five, ten years from now, if we want to maintain our Parks to the same quality as we have today, each employee will cost more. It’s inescapable and we may need to make tough trade-offs going forward.

My Verdict

I think this is a genuinely hard choice. We have real structural problems with our parks. The most recent audit is pretty tough but also fair. Still, it also seems like folks in office and in Parks are starting to recognize the structural issues, even as it’s unclear that they have the political will to fix them.

It’s just not obvious to me that voting for the parks levy will do anything to help. In my most pessimistic moments, I worry we are just enabling a bad cycle get worse. I just don’t know.

Still, this is a little different from the Portland Schools bond to me(which I voted no on). That was a capital bond. A 6 month delay there would have been a real headache for Portland Public Schools but it could have forced a real reckoning without impacting the day to day of students learning.

Here it’s less clear. This is predominantly for operating funds. A no vote may force that same sort of reckoning but it would also definitely be at the expense of hundreds of jobs, having real impacts on real folks, today. What form that takes (worse maintenance, closed pools, no more free lunches for kids) is undetermined. But it really seems like it would hamstring the day to day operations of one of Portland’s best assets.

In the end, I’ve decided to vote yes for the parks levy. That’s the official Mortlandia position.

But if you vote no? I get it. I have reservations too. Throwing good money after bad doesn’t tend to solve anything.

In 2030, when the levy comes up again, I hope we see considerable progress towards controlling costs and ensuring accountability while stabilizing assets. I want to see a solution at the state level to the SDC problem, and a real plan to chip away at the maintenance backlog. If I don’t, I expect you’ll find me voting against a 2030 levy.

How home values are assessed for taxes vs. assessed for sale has to do with a bunch of measures passed in the 90s (specifically Oregon Measure 50, passed in 1997), which capped the rate of growth for tax assessment in Oregon. If you’re wondering why government—and specifically taxes—often feels kind of broken in Oregon, Measure 50 is a good place to start. Not the only place to look though! We do a bunch of strange things here because we are special unique flowers.

If you’re a homeowner, check your most recent Property Tax statement; it comes once a year and is usually bright yellow. On it you should see a line item labeled CITY OF PORTLAND LOC OPT.

That’s actually two levies combined, the 2020 Parks Levy and the 2023 Children’s Levy. About 2/3 of that is what you’re paying to parks for the 2020 levy, the rest is For The Children.)

I don’t see it specified by anyone anywhere but based on press from the 2020 levy, I suspect that would hit summer pool staffing particularly hard and could mean a couple of pool closures.

If you’re curious, they did modernize the data systems but they didn’t use levy funds for it, they used general funds. Money is fungible, I suppose.

Nicely done! I appreciate the deeper dive and breakdown of the finances…

Thank you for making and sharing this write-up! I appreciate the balanced take - subscribed :)